Research · UX · Product Design

Informal Finance

Debt Visibility & Trust

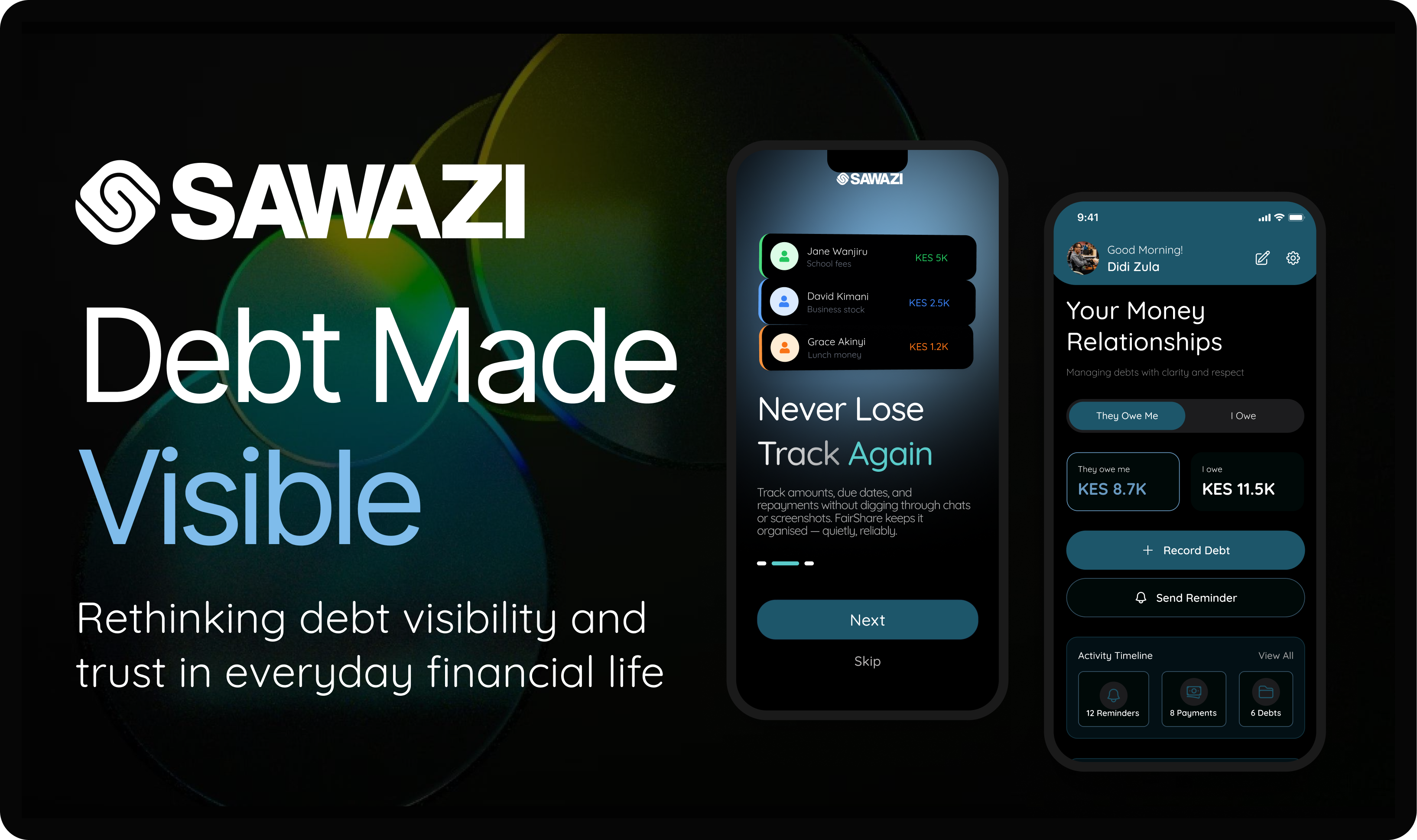

Sawazi explores how people experience and manage informal debt in everyday life. Many existing tools treat debt purely as numbers, ignoring the emotional and social dynamics that shape how people relate to what they owe and are owed. This work focuses on debt visibility as a way to build trust, reduce friction, and create a more approachable experience.

Informal debt isn’t just numbers—it lives in memory, messages, and silence. Most tools ignore the emotional and social dynamics at play, creating anxiety, friction, and sometimes broken trust.

The design opportunity was to make debt visible, approachable, and human-centered: a system that supports communication, reduces tension, and fosters long-term awareness, rather than forcing immediate repayment or judgment.

Informal debt is rarely just financial—it’s social, emotional, and relational. People manage what they owe through memory, messages, or silence, often at the cost of anxiety, miscommunication, and broken trust.

Most financial tools focus on repayment and urgency, ignoring these human dimensions. This created an opportunity to design a platform that supports clarity, trust, and long-term awareness, while respecting the relational and emotional context of debt.

People experience informal debt as a social and emotional challenge, not a transaction. Without the right support, interactions can lead to stress, miscommunication, and damaged relationships.

The challenge was clear: how can we create a platform that respects these human dynamics, while giving users visibility and control over what they owe and are owed? Sawazi is designed to reduce tension, foster transparency, and make debt feel manageable rather than burdensome.

Informal debt is embedded in daily life and relationships. Without tools that reflect its emotional and social complexity, people risk miscommunication, frustration, and damaged trust.

Sawazi provides a platform to navigate obligations in a human-centered way, making debt less transactional and more relational

To design for this space, we focused on uncovering:

1. How people track, remember, and communicate informal debt.

2. The emotional triggers and relational pressures that influence repayment behavior.

3. Where opportunities exist to introduce clarity, trust, and comfort without judgment or urgency.

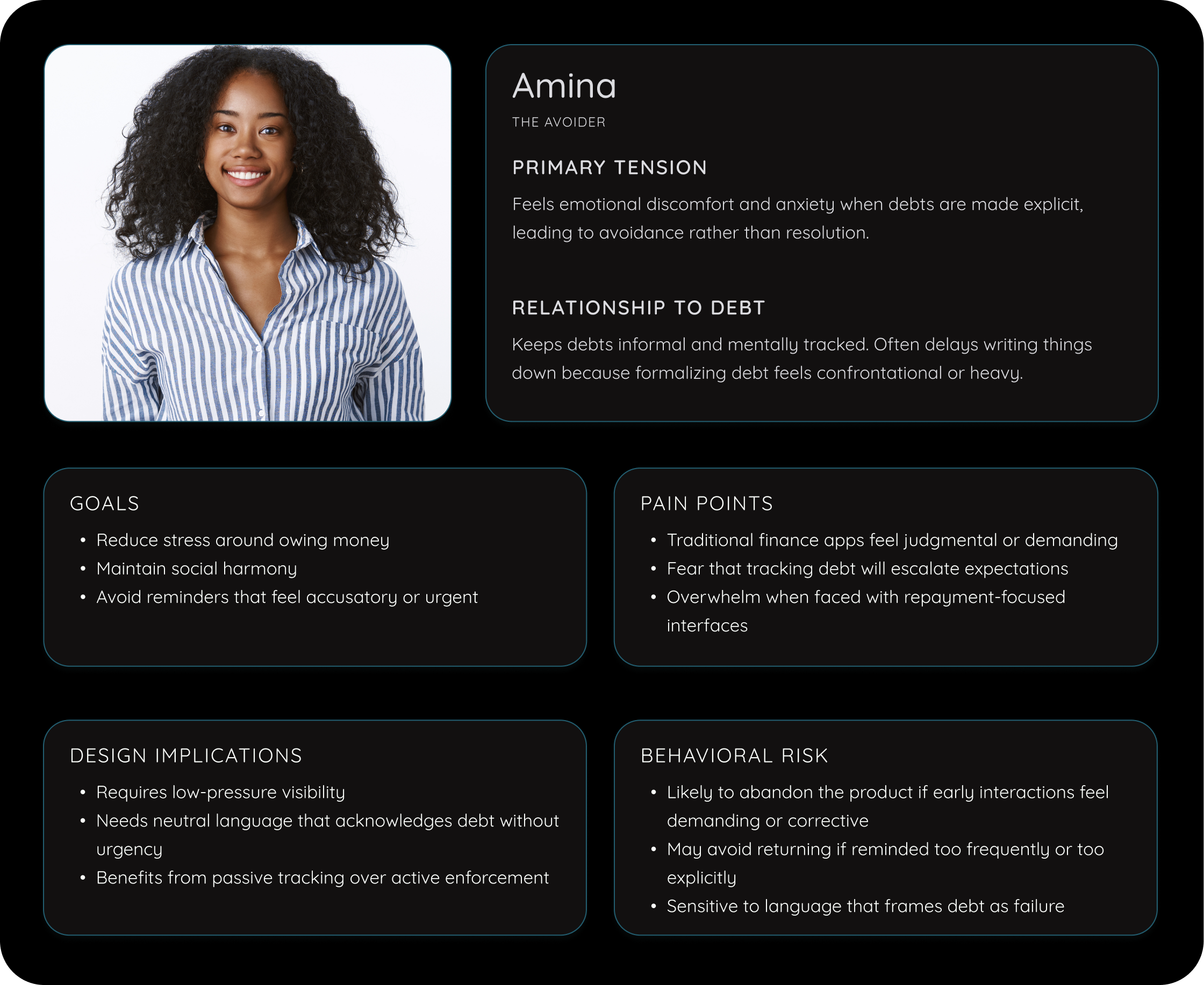

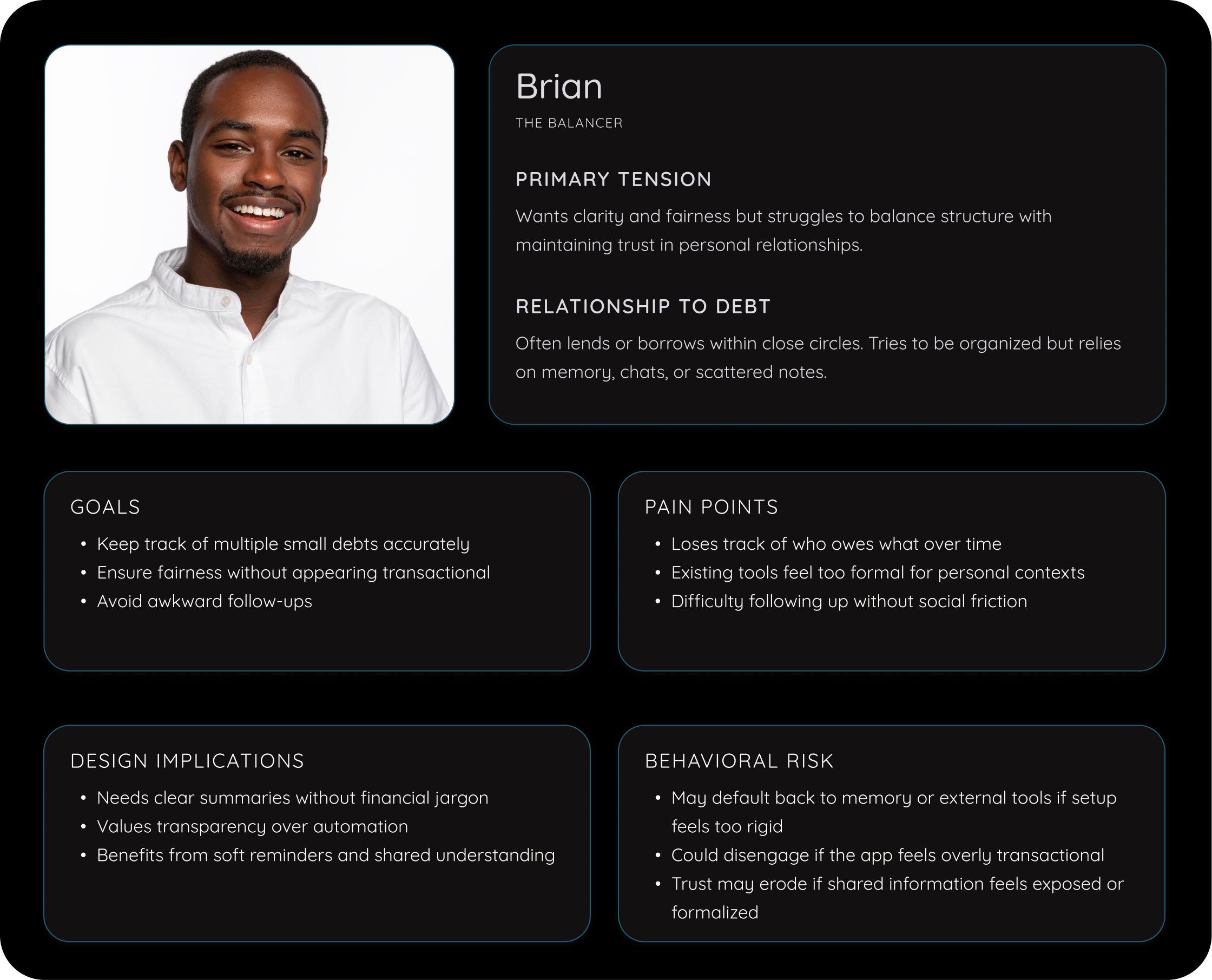

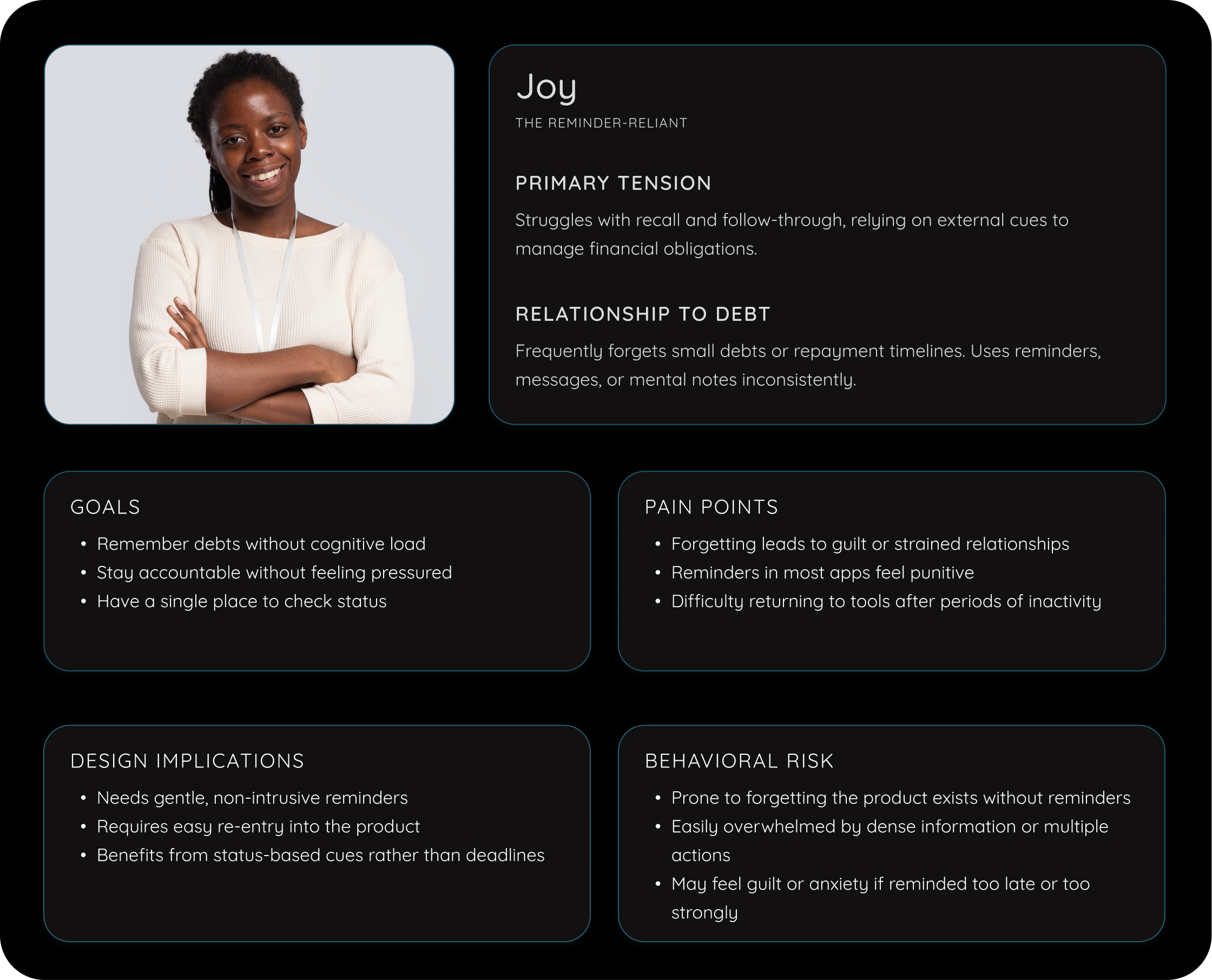

Research surfaced recurring behavioral patterns:

1. Debt avoidance: People delay acknowledging obligations to reduce discomfort.

2. Social negotiation: Repayment decisions are influenced by relationships and trust.

3. Memory reliance: Tracking relies heavily on mental notes or informal reminders, increasing the risk of errors.

4. Low-pressure visibility: Transparency reduces tension and fosters accountability.

Design decisions focus on leveraging these patterns, creating interactions that are transparent, relational, and emotionally intelligent.

Ideation for Sawazi centered on translating behavioral insights into a restrained design strategy. The focus was on creating a platform that prioritizes emotional safety, clarity, and relational trust over efficiency or repayment pressure. Every design decision was guided by the need to reduce tension, maintain dignity, and support long-term awareness.

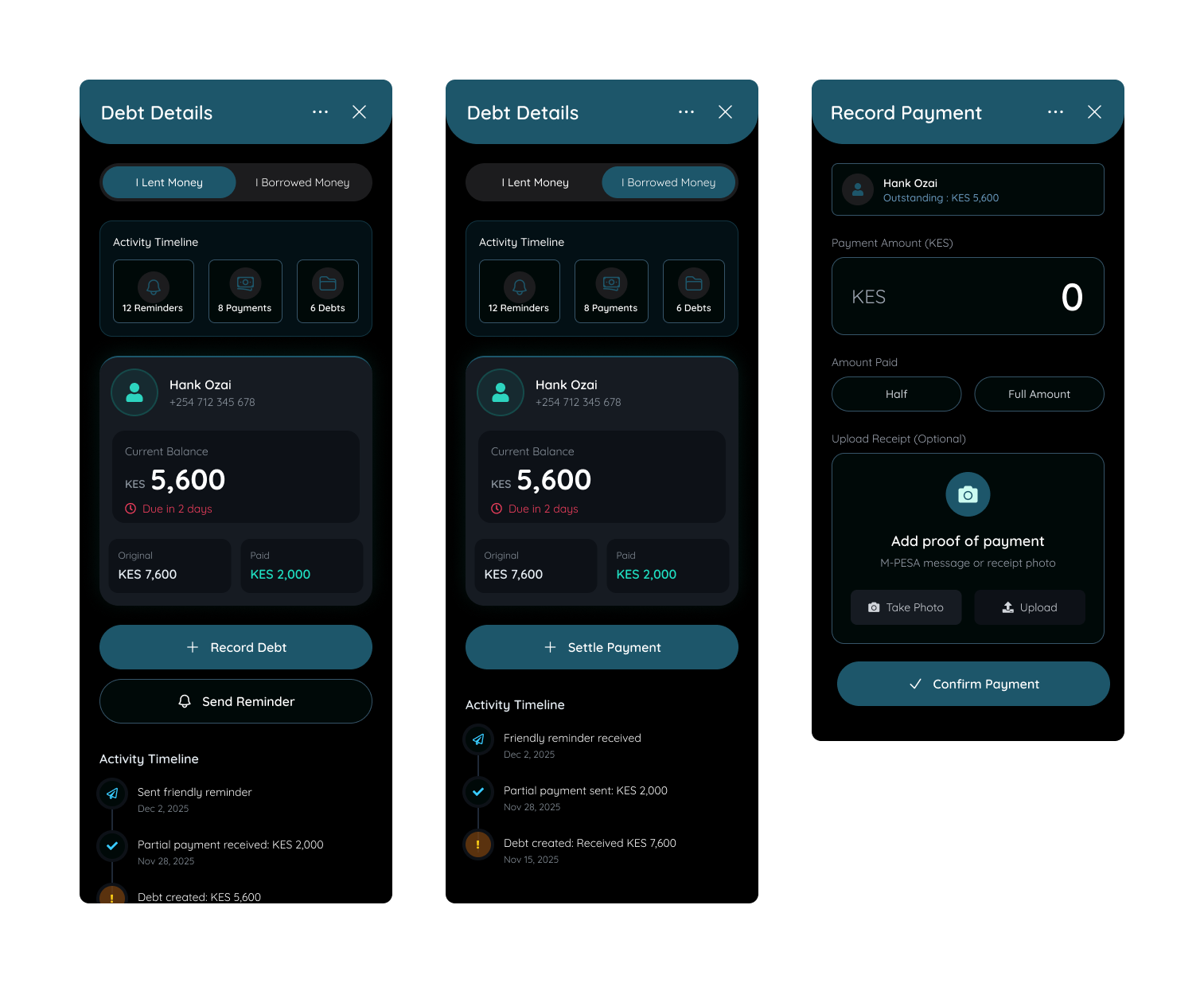

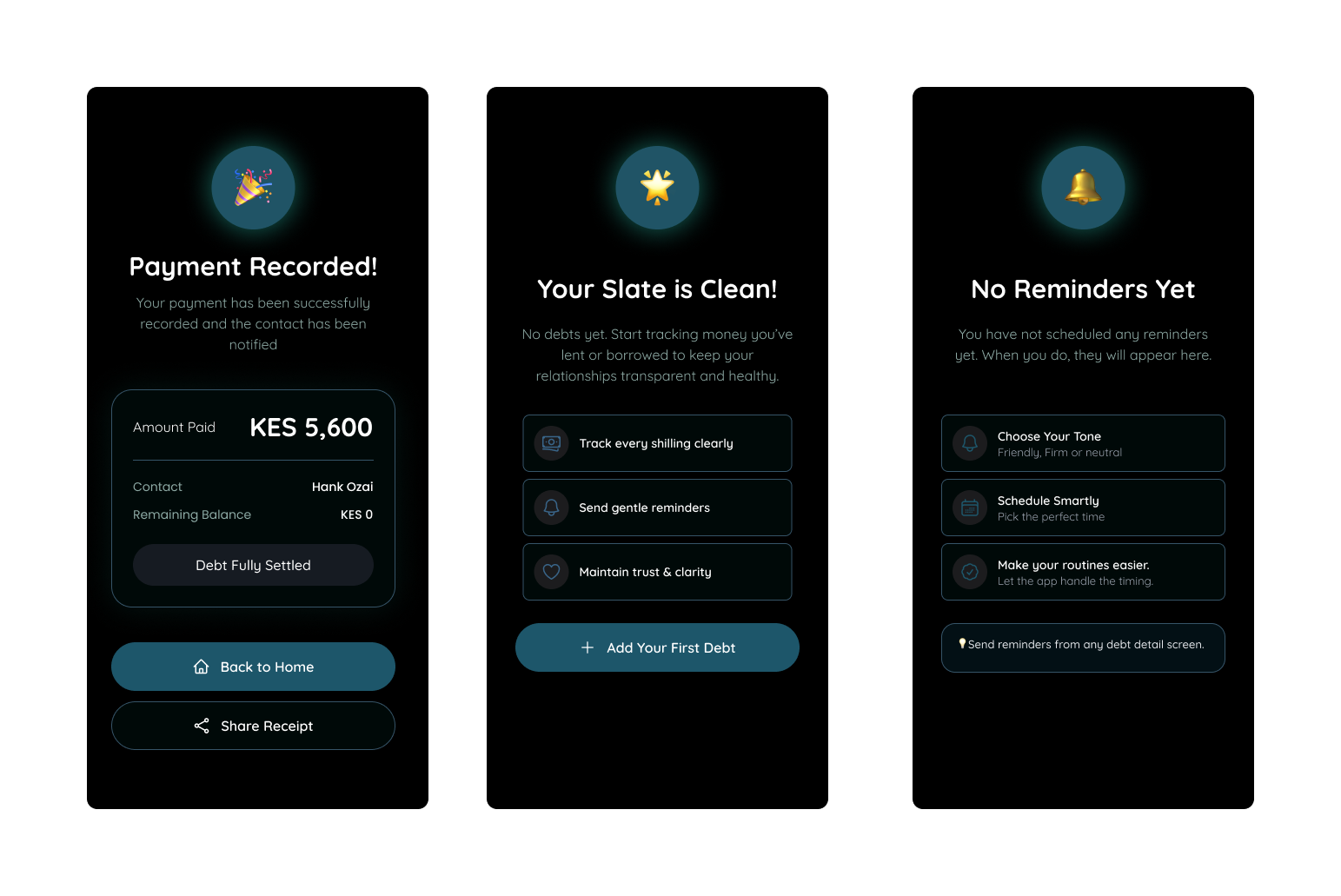

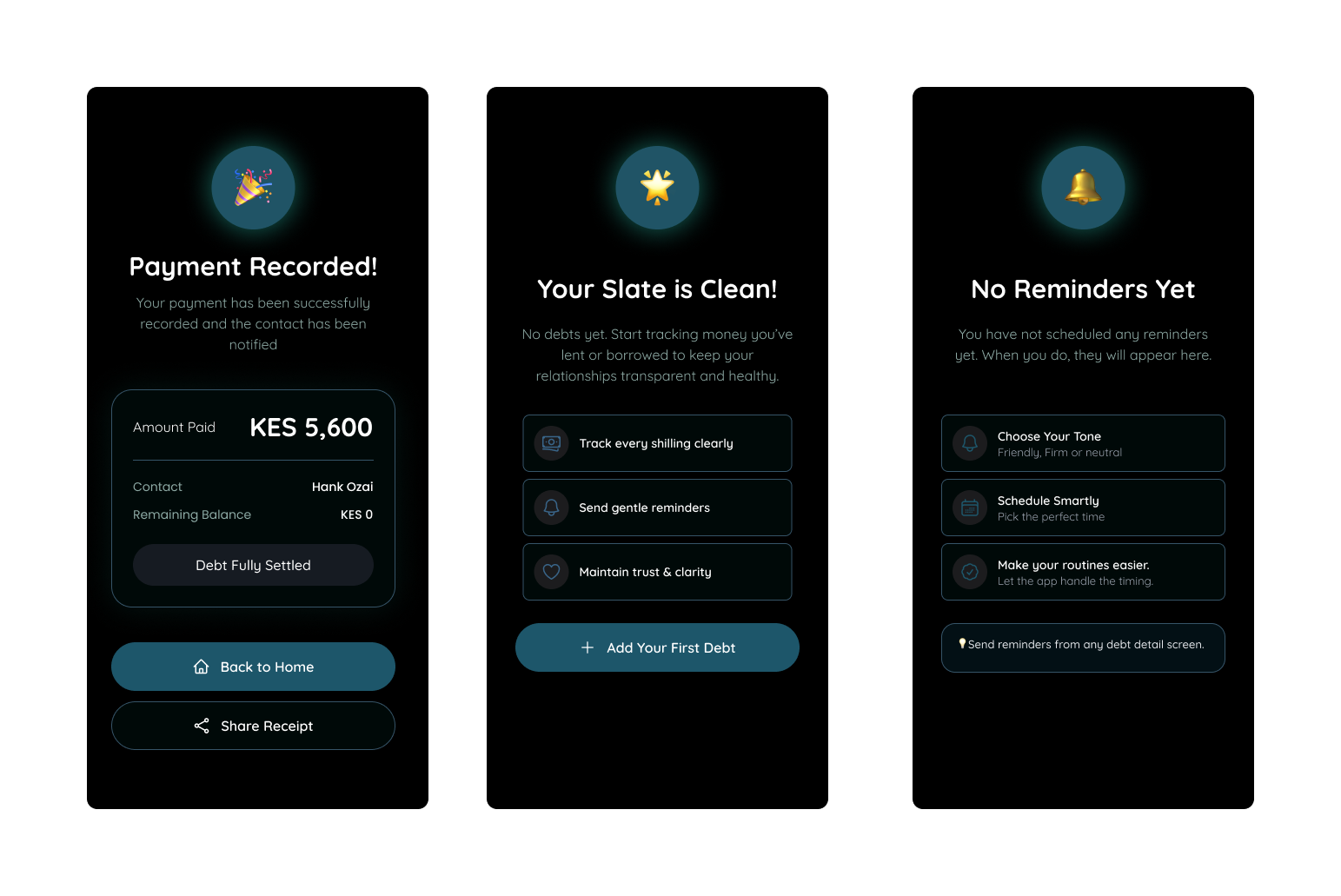

The design execution brought research insights and principles to life through simple, relational, and low-friction interactions. The interface emphasizes clarity, visibility, and emotional safety, ensuring users can engage with debt tracking without stress or judgment.

My final screens reflect a solution-oriented strategy, directly addressing user needs and feedback. They present an intuitive, user-centric design, aimed at ensuring efficiency, satisfaction, and ongoing enhancements. These screens are guided by user data, fine-tuned to provide an exceptionally effective and enjoyable language learning experience.

.png)

Key Learnings

1. Designing for emotional safety and relational trust can be as critical as functional efficiency in behavior-driven products.

2. Focusing on patterns and behaviors rather than rigid personas enables more flexible, human-centered solutions.

3. Transparency, clarity, and low-friction interactions foster sustained engagement without coercion.

Opportunities for Growth

1. Explore contextual nudges that further support trust without creating pressure.

2. Expand features for group or community visibility, balancing social accountability with privacy.

3. Investigate data-driven insights to visualize long-term patterns, helping users make informed decisions while preserving emotional safety.

Strategic Impact

Sawazi demonstrates how a product can shift the experience of informal debt from stressful and opaque to manageable, relational, and transparent, highlighting the value of behavior-driven, emotionally intelligent UX in complex social systems.